Next: O-contract Paths - Monotone

Up: Lower Bounds on Path Length

Previous: Overview

-contract Paths - Unrestricted Utility Functions

-contract Paths - Unrestricted Utility Functions

Our first result clarifies one issue in the presentation of [Sandholm, 1998, Proposition 2]: in this

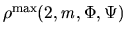

an upper bound that is exponential in  is proved on the length of IR

is proved on the length of IR  -contract paths, i.e.

in terms of our notation, [Sandholm, 1998, Proposition 2] establishes an upper bound on

-contract paths, i.e.

in terms of our notation, [Sandholm, 1998, Proposition 2] establishes an upper bound on

. We now prove a similar order lower bound.

. We now prove a similar order lower bound.

Theorem 3

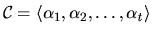

Let

be the predicate which holds whenever

is an IR

-contract and

that which holds whenever

is IR. For

Proof. Consider a path

in

in

,

with the following property4

,

with the following property4

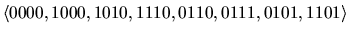

e.g. if  then

then

is such a path as it corresponds to the sequence

.

.

Choose

to be a longest such path with this property that could be formed

in

to be a longest such path with this property that could be formed

in

, letting

, letting

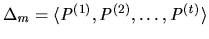

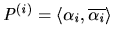

be the sequence of allocations

with

be the sequence of allocations

with

.

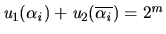

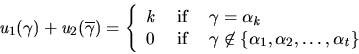

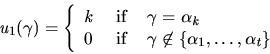

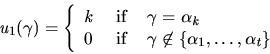

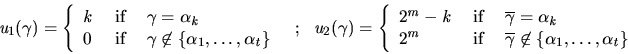

We now define the utility functions

.

We now define the utility functions  and

and  so that for

so that for

,

,

With this choice, the contract path  describes the unique IR

describes the unique IR  -contract path

realising the IR deal

-contract path

realising the IR deal

: that

: that

is an IR

is an IR  -contract path is immediate, since

-contract path is immediate, since

That it is unique follows from the fact that for all  and

and

, the deal

, the deal

is not an

is not an  -contract

(hence there are no ``short-cuts'' possible), and for each

-contract

(hence there are no ``short-cuts'' possible), and for each  there is

exactly one IR

there is

exactly one IR  -contract that can follow it,

i.e.

-contract that can follow it,

i.e.  .5

.5

From the preceding argument it follows that any lower bound on the length of

, i.e. a

sequence satisfying the condition (SC), is a lower bound on

, i.e. a

sequence satisfying the condition (SC), is a lower bound on

.

These paths in

.

These paths in

were originally

studied in [Kautz, 1958] in the context of coding theory and the lower bound

on their length of

were originally

studied in [Kautz, 1958] in the context of coding theory and the lower bound

on their length of  established in [Abbott & Katchalski, 1991].

established in [Abbott & Katchalski, 1991].

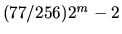

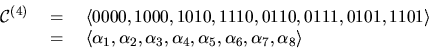

Example 1

Using the path

in the resource allocation setting

, if the

utility functions are specified as in Table

1 below then

and

.

Furthermore,

describes the unique IR

-contract path realising the reallocation

Table 1:

Utility function definitions for  example.

example.

|

|

There are a number of alternative formulations of ``rationality'' which can also be considered.

For example

There are a number of views we can take concerning the rationality conditions

given in Definition 7. One shared feature is that, unlike the concept of

individual rationality for which some provision to compensate agents who suffer a loss in utility

is needed, i.e. individual rationality presumes a ``money-based'' system, the forms defined

in Definition 7 allow concepts of ``rationality'' to be given in ``money-free''

enviroments. Thus, in a cooperatively rational deal, no agent involved suffers a loss in utility and

at least one is better off. It may be noted that given the characterisation of

Definition 4 it is immediate that any cooperatively rational deal is perforce

also individually rational; the converse, however, clearly does not hold in general.

In some settings, an equitable deal may be neither cooperatively nor individually rational. One may

interpret such deals as one method of reducing inequality between the values agents

place on their allocations: for those involved in an equitable deal, it is

ensured that the agent who places least value on their current allocation will obtain

a resource set which is valued more highly. It may, of course, be the case that some agents

suffer a loss of utility: the condition for a deal to be equitable limits

how great such a loss could be. Finally the concept of Pigou-Dalton deal originates from and has

been studied in depth within the theory of exchange economies. This is one of many approaches

that have been proposed, again in order to describe deals which reduce inequality between

members of an agent society, e.g. [Endriss & Maudet, 2004b].

In terms of the definition given, such deals encapsulate the so-called

Pigou-Dalton principle in economic theory: that any transfer of income from a wealthy individual to

a poorer one should reduce the disparity between them.

We note that, in principle, we could define related rationality concepts based on

several extensions of this principle that have been suggested, e.g.

[Atkinson, 1970;

Chateauneuf et al., 2002;

Kolm, 1976]

Using the same  -contract path constructed in Theorem 3, we need only vary the

definitions of the utility functions employed in order to obtain,

-contract path constructed in Theorem 3, we need only vary the

definitions of the utility functions employed in order to obtain,

Proof. We employ exactly the same sequence of allocations  described in the proof of

Theorem 3 but modify the utility functions

described in the proof of

Theorem 3 but modify the utility functions

for each case.

for each case.

- a.

- Choose

with

with  for all

for all

and

and

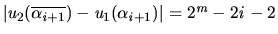

The resulting  -contract path is cooperatively rational: the utility enjoyed by

-contract path is cooperatively rational: the utility enjoyed by  remains constant

while that enjoyed by

remains constant

while that enjoyed by  increases by

increases by  with each deal. Any deviation from this

contract path (employing an alternative

with each deal. Any deviation from this

contract path (employing an alternative  -contract) will result in a loss of utility for

-contract) will result in a loss of utility for  .

.

- b.

- Choose

with

with

and

and

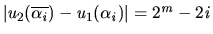

The  -contract path is equitable: both

-contract path is equitable: both  and

and  increase their respective utility values

by

increase their respective utility values

by  with each deal. Again, any

with each deal. Again, any  -contract deviating from this will result in both agents

losing some utility.

-contract deviating from this will result in both agents

losing some utility.

- c.

- Choose

as

as

To see that the  -contract path consists of Pigou-Dalton deals, it suffices to

note that

-contract path consists of Pigou-Dalton deals, it suffices to

note that

for each

for each  . In addition,

. In addition,

which is strictly less than

which is strictly less than

. Finally, any

. Finally, any  -contract

-contract

which deviates from

this sequence will not be a Pigou-Dalton deal since

which deviates from

this sequence will not be a Pigou-Dalton deal since

which violates one of the conditions required of Pigou-Dalton deals.

The construction for two agent settings, easily extends to

larger numbers.

Corollary 2

For each of the choices of

considered in Theorem

3 and

Corollary

1, and all

,

Proof. Fix allocations in which  is given

is given  ,

,  allocated

allocated

, and

, and  assigned

assigned

for each

for each  . Using identical utility functions

. Using identical utility functions

as in each of the previous cases, we employ for

as in each of the previous cases, we employ for  :

:

,

,  whenever

whenever

(

(

as in Theorem 3);

as in Theorem 3);

for all

for all  (Corollary 1(a));

(Corollary 1(a));

,

,  whenever

whenever

(Corollary 1(b)); and, finally,

(Corollary 1(b)); and, finally,

for all

for all  , (Corollary 1(c)). Considering a realisation

of the

, (Corollary 1(c)). Considering a realisation

of the  -deal

-deal

the only

the only

-contract path admissible is the path

-contract path admissible is the path  defined in the related proofs. This

gives the lower bound stated.

defined in the related proofs. This

gives the lower bound stated.

We note, at this point, some other consequences of Corollary 1 with respect to

[Endriss & Maudet, 2004b, Theorems 1, 3], which state

Fact 1

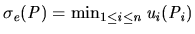

We recall that a

-path,

is

maximal if for each

allocation

,

is

not a

-deal.

- a.

- If

is any maximal path of cooperatively rational deals

then

is any maximal path of cooperatively rational deals

then  is Pareto optimal.

is Pareto optimal.

- b.

- If

is any maximal path of equitable deals

then

is any maximal path of equitable deals

then  maximises the value

maximises the value

, i.e. the so-called

egalitarian social welfare.

, i.e. the so-called

egalitarian social welfare.

The sequence of cooperatively rational deals in Corollary 1(a) terminates

in the Pareto optimal allocation  : the allocation for

: the allocation for  always

has utility

always

has utility  and there is no allocation to

and there is no allocation to  whose utility can exceed

whose utility can exceed  . Similarly,

the sequence of equitable deals in Corollary 1(b) terminates in the

allocation

. Similarly,

the sequence of equitable deals in Corollary 1(b) terminates in the

allocation  , for which

, for which

the maximum that can be attained for the instance defined. In both cases, however, the optima

are reached by sequences of exponentially many (in

the maximum that can be attained for the instance defined. In both cases, however, the optima

are reached by sequences of exponentially many (in  ) deals: thus, although Fact 1

guarantees convergence of particular deal sequences to optimal states it may be the

case, as illustrated in Corollary 1(a-b), that the process of convergence

takes considerable time.

) deals: thus, although Fact 1

guarantees convergence of particular deal sequences to optimal states it may be the

case, as illustrated in Corollary 1(a-b), that the process of convergence

takes considerable time.

Next: O-contract Paths - Monotone

Up: Lower Bounds on Path Length

Previous: Overview

Paul Dunne

2004-11-26

![]() in

in

![]() ,

with the following property4

,

with the following property4

![]() to be a longest such path with this property that could be formed

in

to be a longest such path with this property that could be formed

in

![]() , letting

, letting

![]() be the sequence of allocations

with

be the sequence of allocations

with

![]() .

We now define the utility functions

.

We now define the utility functions ![]() and

and ![]() so that for

so that for

![]() ,

,

![]() , i.e. a

sequence satisfying the condition (SC), is a lower bound on

, i.e. a

sequence satisfying the condition (SC), is a lower bound on

![]() .

These paths in

.

These paths in

![]() were originally

studied in [Kautz, 1958] in the context of coding theory and the lower bound

on their length of

were originally

studied in [Kautz, 1958] in the context of coding theory and the lower bound

on their length of ![]() established in [Abbott & Katchalski, 1991].

established in [Abbott & Katchalski, 1991].![]()

![]() -contract path constructed in Theorem 3, we need only vary the

definitions of the utility functions employed in order to obtain,

-contract path constructed in Theorem 3, we need only vary the

definitions of the utility functions employed in order to obtain,

![]() described in the proof of

Theorem 3 but modify the utility functions

described in the proof of

Theorem 3 but modify the utility functions

![]() for each case.

for each case.

![]() is given

is given ![]() ,

, ![]() allocated

allocated

![]() , and

, and ![]() assigned

assigned

![]() for each

for each ![]() . Using identical utility functions

. Using identical utility functions

![]() as in each of the previous cases, we employ for

as in each of the previous cases, we employ for ![]() :

:

![]() ,

, ![]() whenever

whenever

![]() (

(

![]() as in Theorem 3);

as in Theorem 3);

![]() for all

for all ![]() (Corollary 1(a));

(Corollary 1(a));

![]() ,

, ![]() whenever

whenever

![]() (Corollary 1(b)); and, finally,

(Corollary 1(b)); and, finally,

![]() for all

for all ![]() , (Corollary 1(c)). Considering a realisation

of the

, (Corollary 1(c)). Considering a realisation

of the ![]() -deal

-deal

![]() the only

the only

![]() -contract path admissible is the path

-contract path admissible is the path ![]() defined in the related proofs. This

gives the lower bound stated.

defined in the related proofs. This

gives the lower bound stated.![]()